Coronavirus : A visual guide to the economic impact - The coronavirus flare-up, which started in China, has contaminated in excess of 200,000 individuals. Its spread has left organizations around the globe checking costs.

Here are ten key maps and diagrams to assist you with understanding the financial effect of the infection up until now.

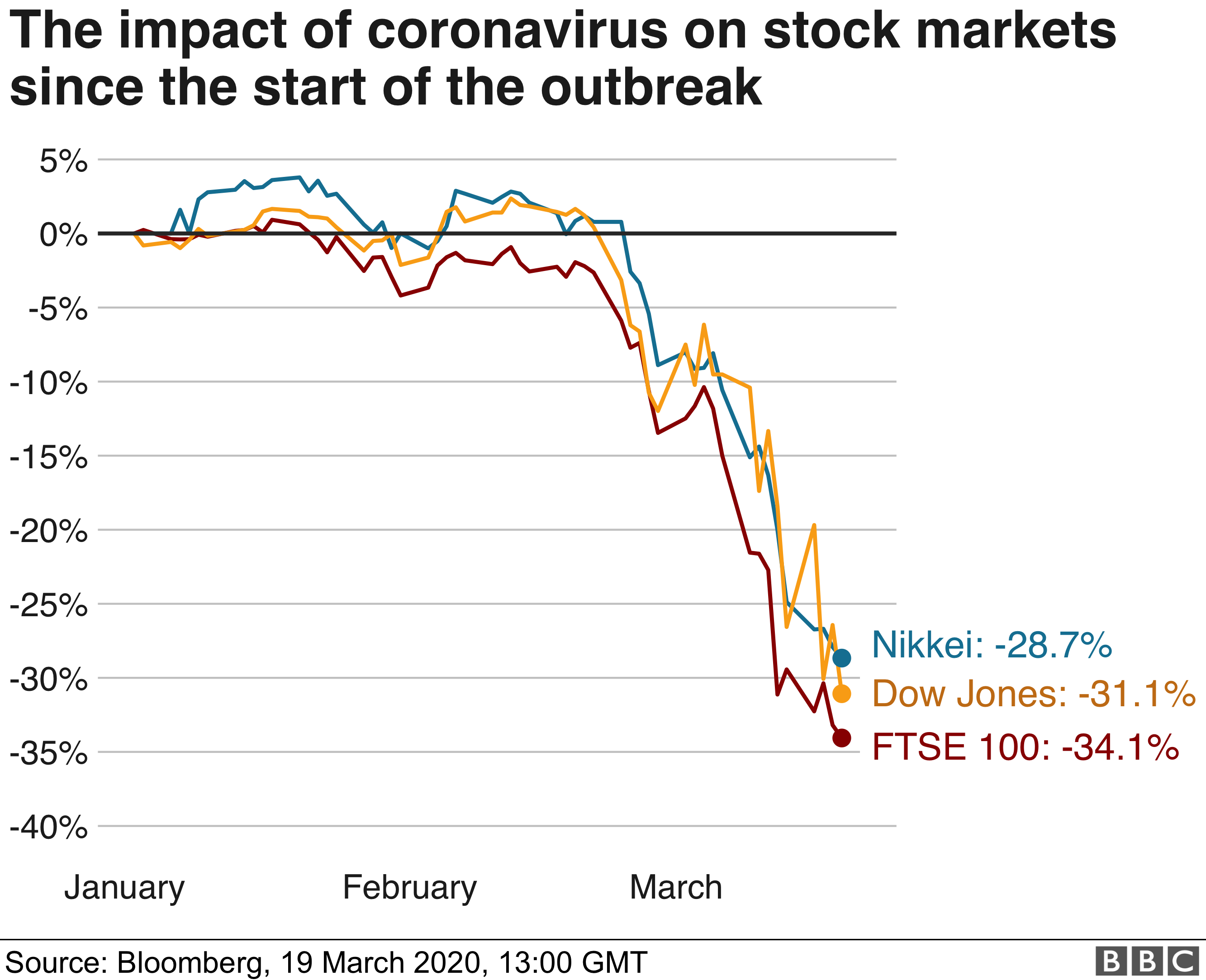

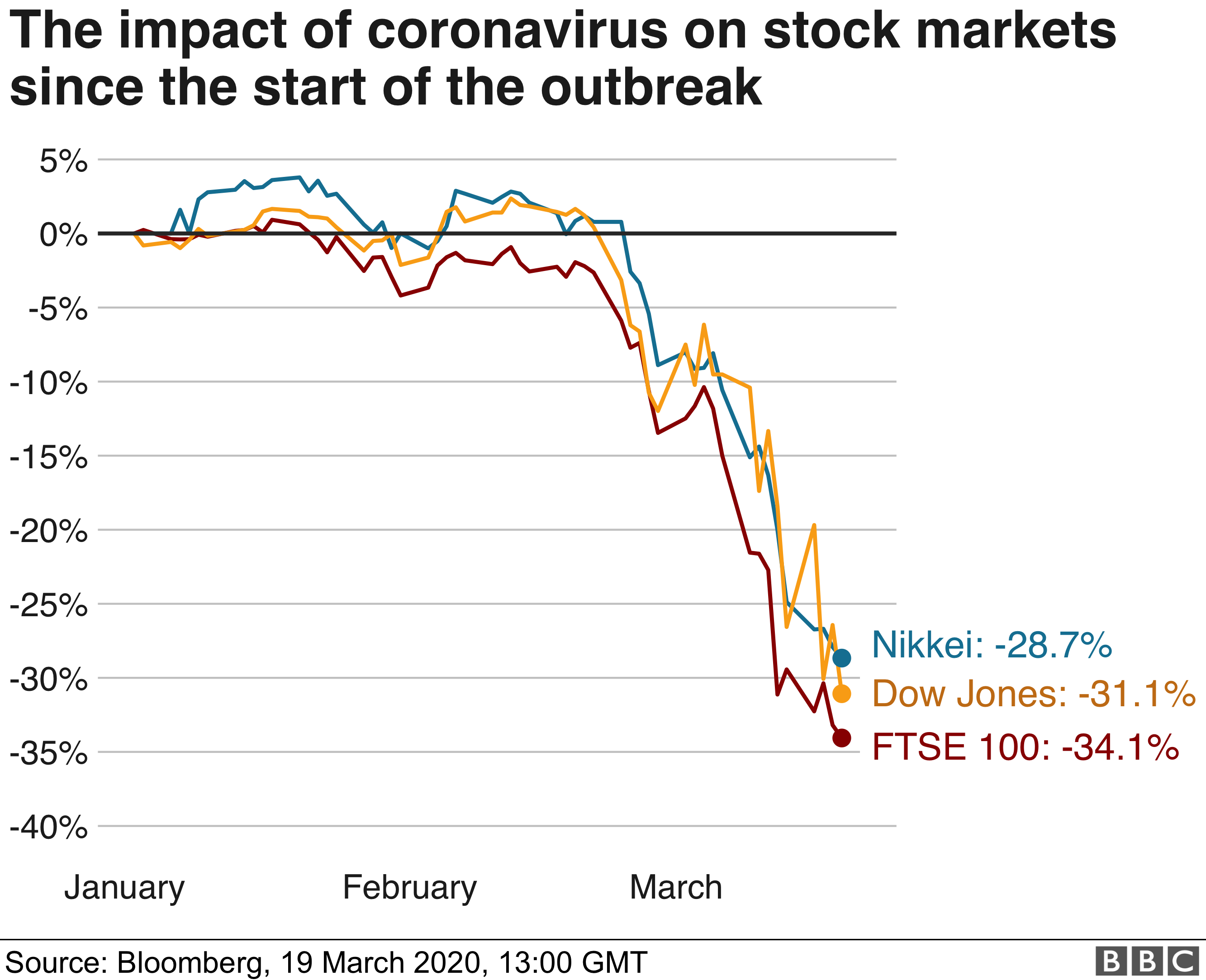

Worldwide offers endure a shot

Huge moves in securities exchanges, where partakes in organizations are purchased and sold, can influence numerous interests in benefits or individual investment accounts (ISAs).

The FTSE, Dow Jones Industrial Average and the Nikkei have all observed immense falls since the flare-up started on 31 December.

The Dow and the FTSE have seen their greatest one day decays since 1987.

Speculators dread the spread of the coronavirus will devastate monetary development and that administration activity may not be sufficient to stop the decay.

Accordingly, national banks in numerous nations have cut loan fees.

That should, in principle, make acquiring less expensive and urge spending to help the economy.

The US Federal Reserve and the Bank of England are among those to slice financing costs.

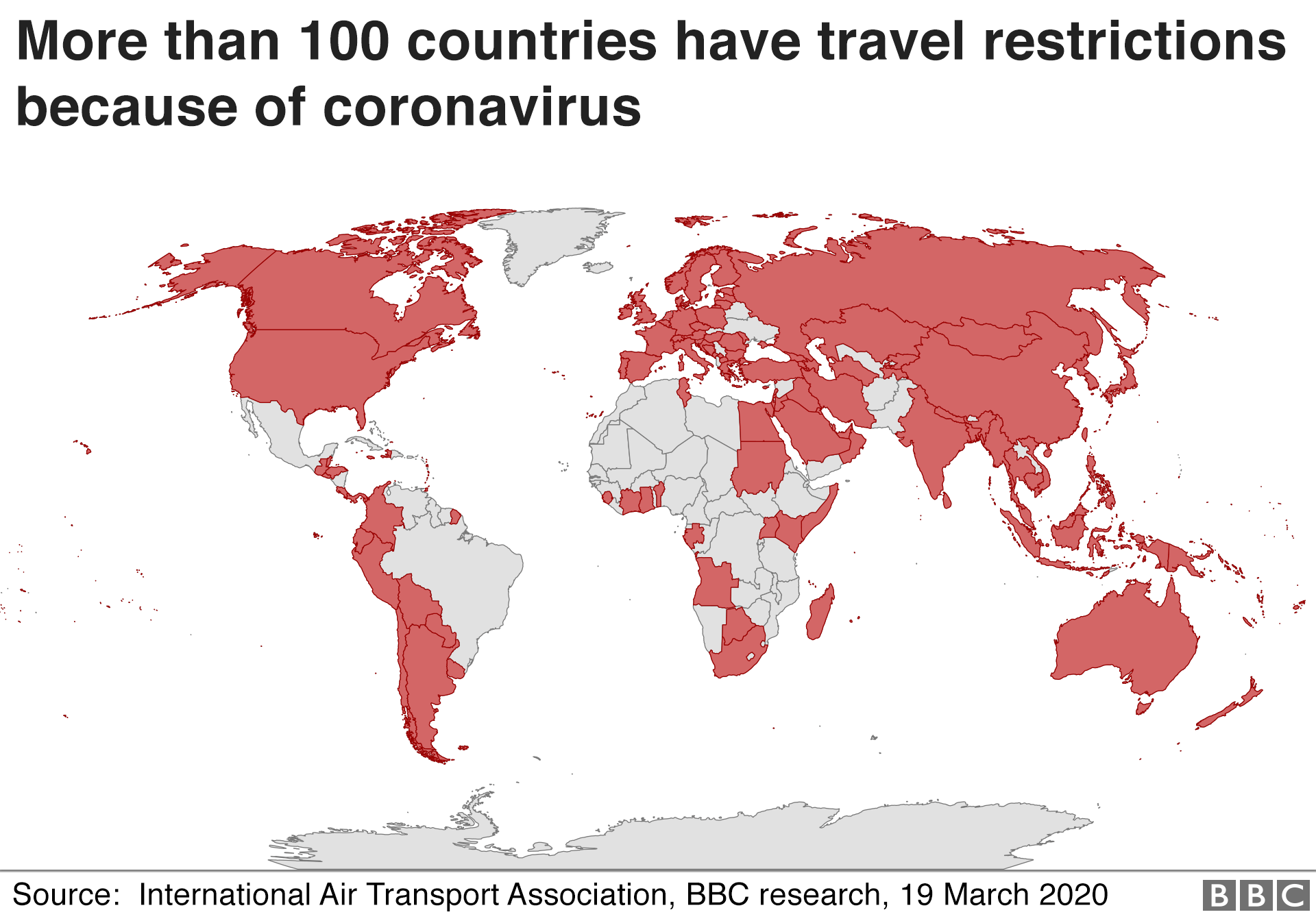

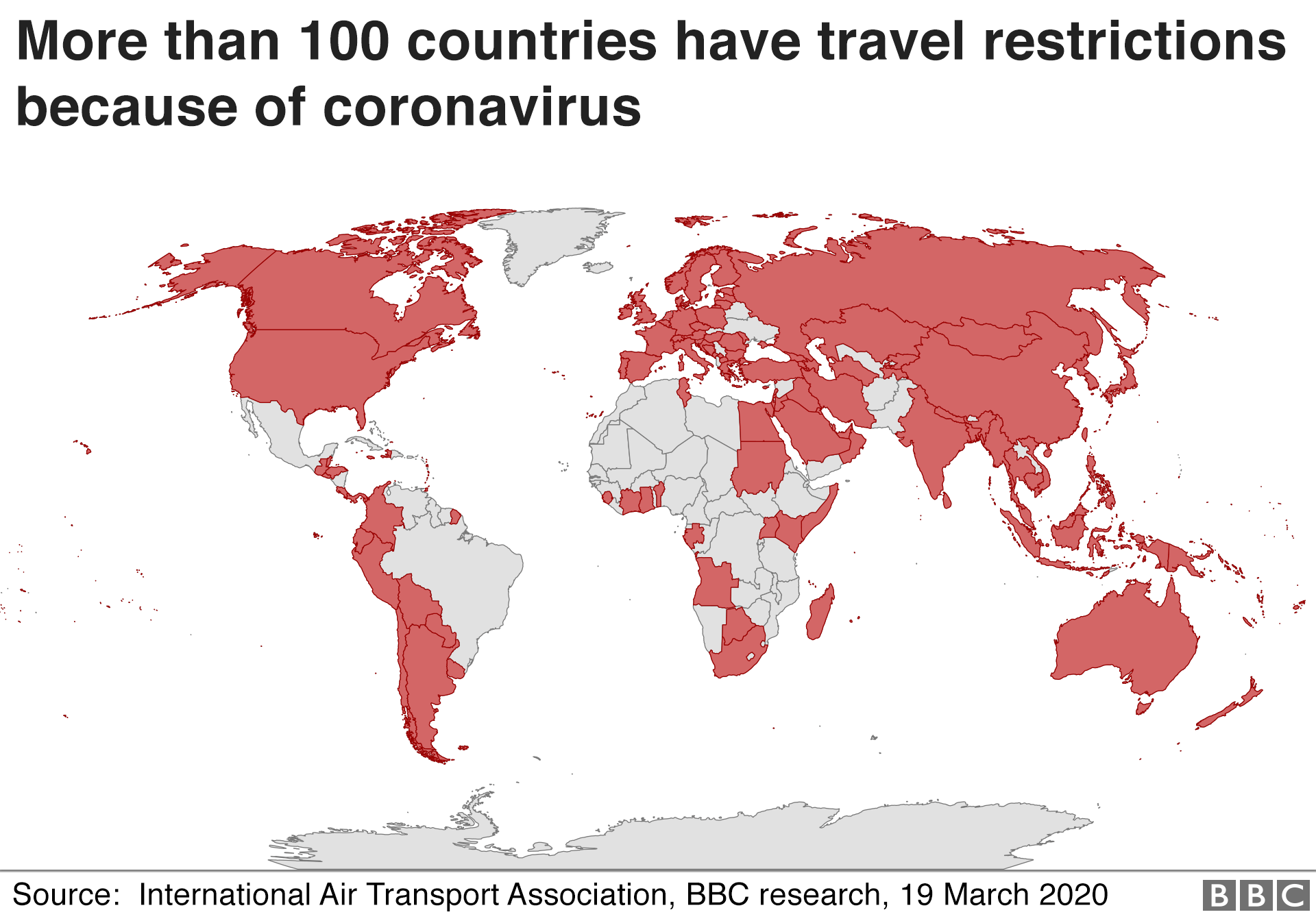

Travel among hardest hit

The movement business has been gravely harmed, with aircrafts cutting flights and sightseers dropping excursions for work and occasions.

Governments around the globe have acquainted travel limitations with attempt to contain the infection.

The EU is forbidding voyagers from outside the coalition for 30 days in an exceptional move to seal its fringes in the midst of the coronavirus emergency.

In the US, the Trump organization has set limitations on air traffic to and from Europe.

Information from investigation firm ForwardKeys for the period up to 8 March shows universal flights booked from the US were behind by 37% in examination with a similar period in 2019.

UK travel industry specialists have communicated worries about Chinese voyagers being kept at home. There were 415,000 visits from China to the UK in the a year to September 2019, as indicated by VisitBritain. Chinese voyagers likewise burn through multiple times more on a normal visit to the UK at £1,680 each.

Clients purchasing less

Dread of the infection and government exhortation to remain at home is likewise devastatingly affecting inns and eateries.

Processing plants in China eased back down

In China, where the coronavirus first showed up, modern creation, deals and speculation all fell in the initial two months of the year, contrasted and a similar period in 2019.

China makes up 33% of assembling comprehensively, and is the world's biggest exporter of products.

China's modern log jam has even been obvious from space.

Nasa said contamination observing satellites had identified a critical drop in nitrogen dioxide over the nation. Proof recommends that is "in any event halfway" because of the financial stoppage brought about by the flare-up.

Limitations have influenced the stock chains of enormous organizations, for example, mechanical gear maker JCB and carmaker Nissan.

Shops and vehicle sales centers have all announced a fall sought after.

Chinese vehicle deals, for instance, dropped by 92% during the principal half of February. More carmakers, similar to Tesla or Geely, are presently selling vehicles online as clients avoid showrooms.

Significantly 'more secure' speculations hit

At the point when an emergency hits, financial specialists frequently pick less dangerous ventures.

Gold is customarily viewed as a "place of refuge" for interest in the midst of vulnerability.

Until March the cost of gold expanded. Be that as it may, presently, with financial specialists progressively dreadful about a worldwide downturn, even the cost of gold has tumbled.

In like manner, oil has drooped to its most minimal cost since June 2001.

Financial specialists dread that the worldwide spread of the infection will additionally hit the worldwide economy and interest for oil.

The oil cost had just been influenced by a line between Opec, the gathering of oil makers, and Russia. Coronavirus has driven the cost down further.

Development could stagnate

In the event that the economy is developing, that for the most part implies more riches and all the more new openings.

It's deliberate by taking a gander at the rate change in total national output, or the estimation of merchandise and enterprises delivered, regularly more than a quarter of a year or a year.

The world's economy could develop at its slowest rate since 2009 this year due to the coronavirus flare-up, as indicated by the Organization for Economic Cooperation and Development (OECD).

The research organization has conjecture development of only 2.4% in 2020, down from 2.9% in November.

It additionally said that a "more drawn out enduring and progressively concentrated" episode could divide development to 1.5% in 2020 as plants suspend their movement and laborers remain at home to attempt to contain the infection.